Q4 2023: Quarterly Briefing – Nordic Investments

Dear Cleantech Scandinavia Member,

As many of you know we entered a partnership with Breakthrough Energy last year to establish Cleantech for Nordics. It is a coalition of Nordic investors and entrepreneurs that have come together to engage with Nordic (and European) policymakers to inspire them to take action to accelerate growth in Nordic cleantech.

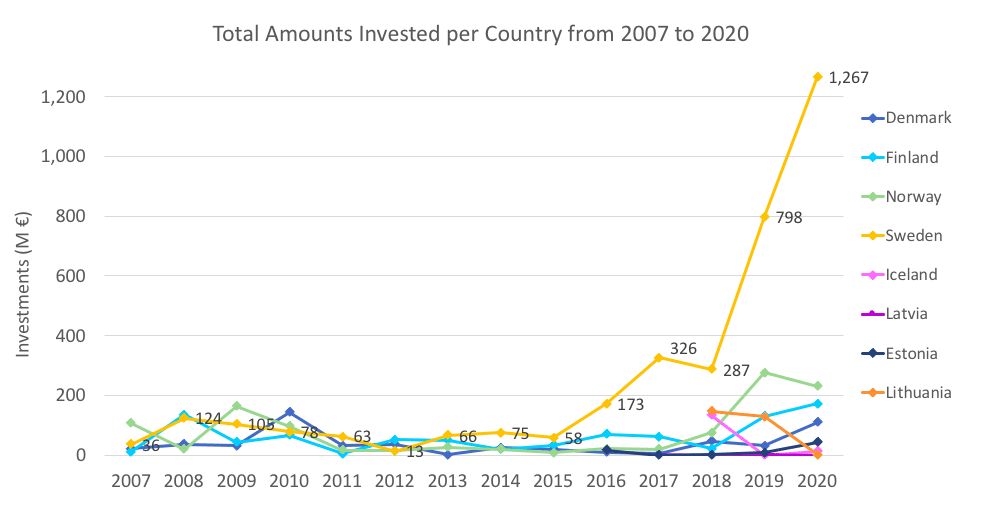

In this project we have started to communicate regularly in different ways. We write papers and articles and drive certain processes on for example how to solve the cleantech scale up investment gap and to promote cleantech innovation in general. We have started to publish a Quarterly Briefing from the Nordics that contains everything from investment statistics to the latest in terms of policy development, scale ups, funding models etc.

It feels natural that we would share this with our members and therefore you will receive these Q-briefs in good time before they are published to the general public. We hope you will appreciate these and we welcome any kind of feedback you may have.

Best Regards

Laura and Magnus